What is DTI?

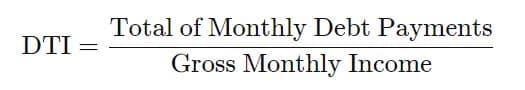

A debt-to-income ratio (DTI) is the percentage of your monthly income that is used towards your monthly debt.

It is one of the key factors that lenders use to decide whether or not you qualify for a loan. Apart from your Credit Score and your Income, DTI can make or break your loan. Lenders use DTI to determine how well you can manage your bills. This way, they can estimate your ability to manage and pay back the money you plan to borrow through your mortgage.

The lower your DTI ratio, the better your probability of qualifying for a mortgage. In other words, the lower the percentage of your income that is needed to pay off your debt, the better chance you have of qualifying for a loan.

Types of DTI

- Front-End DTI calculates the percentage of income spent on housing-related expenses such as mortgage payments, homeowners’ insurance, property taxes, and HOA fees. If you add up your housing-related expenses and divide it by your gross monthly income you get your front-end DTI.

- For example, if your mortgage is $1,800, home insurance $150, property taxes $400, and other housing-related expenses $350, then your total housing-related expenses are $2,700. Additionally, if your monthly income is $8,000 –

- Your Front-End DTI is $2,700/$8,000 = 34%

- Back-End DTI calculates the percentage of income spent on all other types of debt such as credit cards, student loans, and car loans – including housing-related expenses. If you add up all other types of debt and housing-related expenses and divide it by your monthly income, you get your back-end DTI.

- Your Back-End DTI would be $4,300/$8,000 = 54%

Although both front-end and back-end DTI’s are important, most lenders will typically focus on your back-end DTI for conventional loans. This is because your back-end DTI takes into account your total debt amount.

For government backed loans, such as FHA loans, lenders will look at both DTI’s and may accept higher DTI’s depending on the lender.

What is a Good DTI?

The maximum DTI ratio that is allowed varies from lender to lender. However, in general, 43% is the highest DTI a borrower can have to qualify for a conventional loan. On the other hand, for government-backed loans, some lenders may accept up to 50% DTI.

A DTI that is 36% or lower with no more than 28% going towards housing expenses is what most lenders consider an ideal DTI to have.

- Reminder: The lower your DTI, the better your chances of qualifying for a mortgage.

How to Lower Your DTI?

If your DTI is too high, it is recommended that you wait to take out any loan as it’s likely you may not qualify. Additionally, it may be more difficult for you to keep up with the monthly mortgage payments if a majority of your income is already going towards paying off other debt.

Below are 5-steps you can take that may help lower your DTI:

- Reassess your budget to pay off your debt earlier

- Begin paying off your credit cards in full each month (Do not close your credit cards once they are paid off as this can hurt your credit score)

- Refinance or consolidate your current loans to reduce monthly payments

- Always keep track of your credit report and make sure all debt is accurate and up to date

- Let us know if you plan on living with a roommate, parent, or partner as we might be able to include some of that income when calculating your DTI