With the financial markets in a tailspin, where does the individual investor go from here to get a meaningful return on savings and investments in 2020?

One interesting aspect of ‘global crisis’ situations (epidemics, perceived negative geo-political events, natural disasters etc.) is that, historically, any such negative event/ outcome has driven global investors to ‘safe haven’ investment opportunities, which invariably are the US Treasuries. Consequently, demand for US Treasury bonds drives up bond prices and pushes benchmark rates lower.

The net impact is that benchmark interest rates in the US decline.

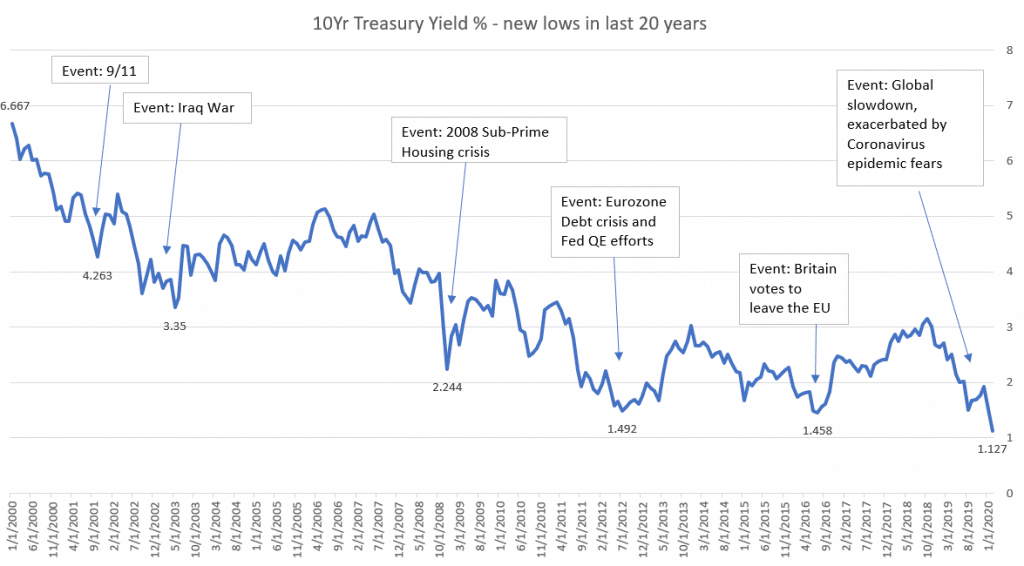

Below is a high level interest rate chart that captures this phenomenon as witnessed in the 10 Year Treasury rate movement over the last 20 years:

Data Source: Yahoo Finance

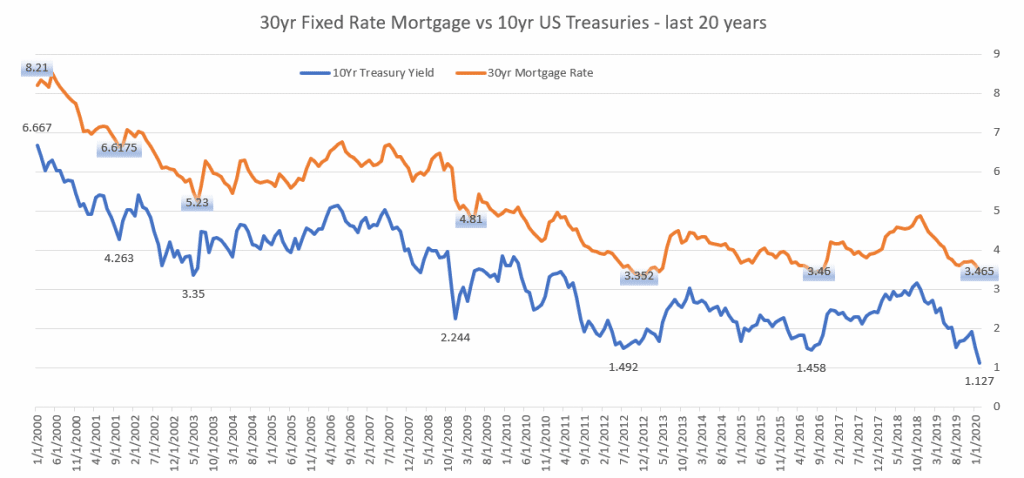

Amongst all the benchmark interest rates, the 10yr rate is most closely correlated to mortgage rates because of the similarities in the durations of the 10 year govt bond and the 30 year MBS which has been in the 6-7 year ballpark.

This relationship can also be observed in the chart below.

Hence, it seems like the US homeowner with a mortgage is one of the biggest beneficiaries of all these interest rate declines because of adverse, global events that keep driving mortgage rates in the US lower?

With an ongoing and impending stock market correction and an extended, extremely low interest rates environment, where does one invest their savings? Several investors have turned to liquidating investments in relatively risky assets and keeping the same in cash.

Data Source: Yahoo Finance and Freddie Mac’s PMMS

Question: Given that most homeowners have mortgages and interest rates on those continue to be much over 3%, how about parking some cash in your mortgage?

For example, lets assume that a homeowner has a $300,000 outstanding balance on their mortgage with a 30 year fixed rate of say 4.00%, a Loan to Value (LTV) of say 85% and a credit score of say 740. In this example the monthly Principal and Interest for the homeowner works out to $1432.25.

Eligibility for low Mortgage rates is a function of multiple factors including Credit score, LTV and loan products. In our example, if we assume the homeowner has some cash deposits and can bring in say $20,000 to lower his LTV from 85% to under 80% and become eligible for a 30 year fixed rate of 3.00% ( which is quite possible in the current market), he will drop his monthly payment to $1180.49. This is a monthly savings of $251.75 on his mortgage payment. On an annualized basis that is a savings of $3021.06 or almost 15% return on his cash used to improve LTV and Refinance his mortgage! Excluded in the above calculation is his PMI elimination, which will only add to his ROI. This scenario does not only apply to homeowners with >80% LTV and paying Private Mortgage Insurance, it can also apply to folks who fall just above the Fannie Mae loan level price adjusters based on LTV bands. The most recent Fannie Mae LLPA grid gives pricing benefits to LTV’s that are less than or equal to 60%, 70% and 75% in addition to the <=80% LTV in above example.

The bottom-line is: In the current rate environment, consumers with strong credit profiles and cash idled from ‘flight to safety’ investment decisions can benefit significantly from a ‘Cash-In’ Refinance of their mortgage. It’s an investment secured against their property and any reduction in monthly mortgage payments is as good as an income/ return on the cash-in portion that was used to obtain the lower rate.